The job hunt. For many, it’s a journey filled with anticipation, hope, and a touch of anxiety. You meticulously craft your resume, network with professionals, and scour job boards, all in pursuit of that perfect opportunity. But what if that “perfect opportunity” is nothing more than a carefully constructed illusion designed to exploit your ambition? Fake job advertisements are a growing menace in the digital age, preying on unsuspecting individuals to steal personal information, commit financial fraud, or worse. The U.S. Federal Trade Commission (FTC) frequently issues warnings about these scams, noting that employment-related scams are a significant source of consumer complaints.

This isn’t just about dashed hopes; it’s about safeguarding your identity, your finances, and your time. Whether you’re a recent graduate eager to start your career, a seasoned professional looking for a change, or a decision-maker aiming to protect your organization’s integrity, understanding how to spot these fraudulent postings is crucial. This article will delve into ten critical red flags that can help you distinguish a legitimate offer from a deceptive trap, providing the technical insight and informational depth needed to navigate the modern job market securely.

The “Why”: Understanding the Motives Behind Fake Job Ads

Before we dissect the warning signs, it’s essential to understand why scammers invest time and effort into creating these elaborate charades. Their motivations are varied, but almost always malicious:

- Data Harvesting (Identity Theft): This is a primary driver. Fake job applications often request extensive personal information, such as your Social Security number (SSN), driver’s license details, date of birth, and even bank account information (under the guise of setting up direct deposit). This data is a goldmine for identity thieves, who can use it to open fraudulent accounts, file fake tax returns, or sell it on the dark web. The Identity Theft Resource Center (ITRC) consistently reports job-related scams as a vector for identity compromise.

- Financial Scams: Some fake job ads lead to scenarios where victims are tricked into sending money. This could be for “training materials,” “processing fees,” “background checks,” or even to purchase equipment for a supposed work-from-home position. A common tactic involves sending the “new hire” a fake check, instructing them to deposit it and wire a portion back or to another “vendor.” The check eventually bounces, leaving the victim responsible for the withdrawn funds.

- Unpaid Labor: Scammers might assign “test projects” or “trial tasks” that are, in reality, legitimate work they need done. Once the work is submitted, the “employer” disappears, having received free labor. This is particularly common in creative fields like writing, graphic design, or software development.

- Malware Distribution: Clicking on links in fake job ads or downloading “application packs” can lead to malware infections. This malicious software can compromise your device, steal your passwords, or hold your files for ransom (ransomware).

- Reshipping Scams: Some fake jobs, often advertised as “package handler” or “logistics manager” positions (usually work-from-home), involve receiving packages and reshipping them to another address, often overseas. These packages frequently contain goods purchased with stolen credit cards, making the unwitting “employee” an accomplice in money laundering and fraud. The U.S. Postal Inspection Service regularly warns about these schemes.

Understanding these underlying motives helps contextualize the red flags and reinforces the importance of vigilance. Now, let’s explore the tell-tale signs of a fraudulent job posting.

10 Red Flags to Spot a Fake Job Ad

Navigating the job market requires a discerning eye. Here are ten crucial indicators that a job advertisement might be a scam:

1. Vague Job Descriptions and Unrealistic Requirements (Or Lack Thereof)

Legitimate job postings are typically specific about responsibilities, required skills, and experience. Scammers, however, often use generic language to cast a wide net.

- The Red Flag: The job description is overly broad, using buzzwords without substance (e.g., “data entry,” “administrative assistant,” “customer service representative” with minimal detail). It might list duties that are unclear or seem too easy for the advertised pay. Conversely, some ads go the other way, promising high-level positions with minimal or no experience required, often targeting entry-level job seekers with enticing titles like “Manager” or “Director” without corresponding qualification demands.

- Why it’s a Concern: Generic descriptions allow scammers to appeal to a larger pool of applicants. The lack of specific requirements is a tactic to lure individuals who might not qualify for legitimate roles, making them feel like they’ve stumbled upon a unique, easy opportunity.

- Technical Insight: Look for keywords that are too common or for a complete absence of industry-specific jargon that you’d expect for such a role. If the company is supposedly in a technical field, but the description lacks any technical depth, be wary.

- What to Do: Compare the job description to similar roles advertised by well-known companies. If it seems unusually simplistic or, conversely, offers a grand title for very little experience, proceed with extreme caution. The Better Business Bureau (BBB) often highlights overly simplistic applications and vague responsibilities as hallmarks of job scams.

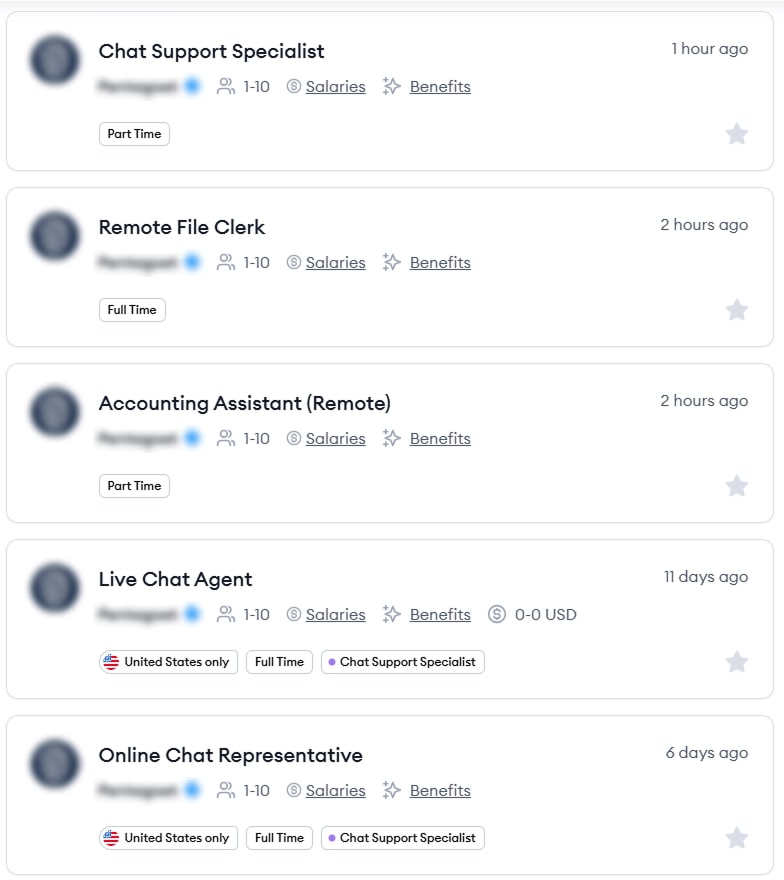

As shown above, a pub is posting job openings for roles such as helpdesk specialists and file clerks on a general job board — positions that clearly don’t match the typical nature of a pub business.

Why such listings aren’t reviewed before publication is another question entirely — one that deserves its own article.

These “easy hire” positions, often requiring little to no experience, are classic bait for data collection. The scammer’s hope is that the allure of an easy job will make applicants overlook the odd context and willingly submit their personal information.

2. Unprofessional Communication: Grammar, Spelling, and Generic Emails

Professional organizations invest in their image, and this extends to their recruitment communications.

- The Red Flag: The job ad or subsequent email communications are riddled with grammatical errors, spelling mistakes, or awkward phrasing. The email address of the recruiter or hiring manager uses a free webmail service (e.g., @gmail.com, @yahoo.com, @outlook.com) instead of a corporate email domain (e.g., @companyname.com), especially if the company is portrayed as large or well-established.

- Why it’s a Concern: While minor typos can happen, consistent errors suggest a lack of professionalism or that the communication originates from individuals who are not native English speakers, which can be (though isn’t always) a characteristic of overseas scam operations. Using generic email addresses is a major red flag because legitimate companies, even small ones, typically use branded email addresses for official correspondence.

- Technical Insight: Scammers may create email addresses that are very similar to legitimate company domains, perhaps adding an extra letter or a hyphen (e.g., @company-name.co instead of @companyname.com). Always scrutinize the sender’s email address carefully. You can also check email headers to see the true origin of the email, though this is more technical. A quick search for the company’s actual career page or contact information can reveal their legitimate email domain format.

- What to Do: Treat unprofessional communications as a serious warning sign. If a company appears to be substantial, cross-reference the recruiter’s email with the company’s official website or LinkedIn profiles of their actual employees.

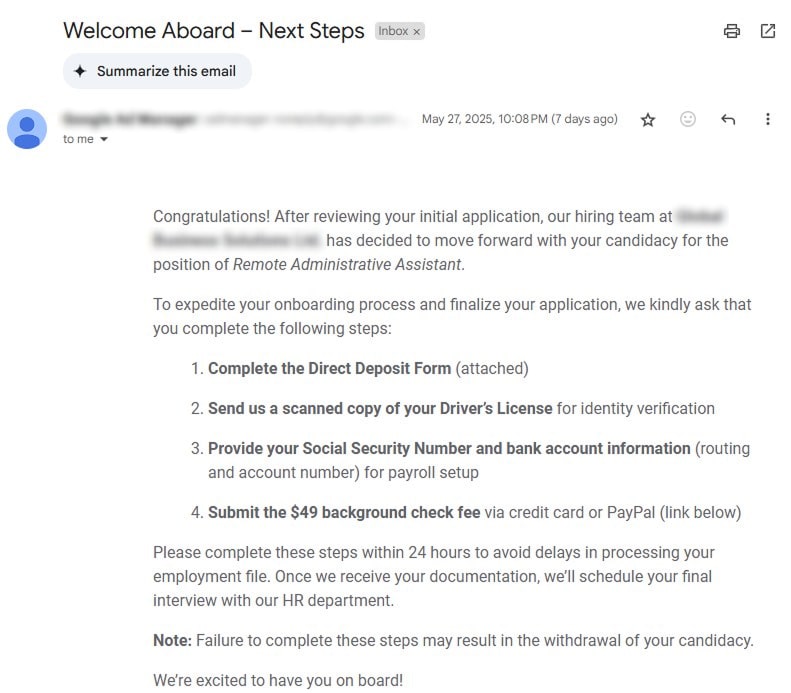

3. Premature Requests for Sensitive Personal or Financial Information

This is one of the most dangerous red flags, directly pointing towards identity theft or financial fraud.

- The Red Flag: You are asked to provide your Social Security number, bank account details (for “direct deposit setup”), credit card information, a copy of your driver’s license, or other highly sensitive data before a formal interview process has been completed, or even before a conditional job offer is made. Some scams might even ask for a fee to submit your application or for a “background check” at this very early stage.

- Why it’s a Concern: Legitimate employers typically only request SSN and bank details after you have accepted a formal job offer and are undergoing the official onboarding process (e.g., filling out I-9 and W-4 forms). There is absolutely no legitimate reason for an employer to need your bank account details or credit card number during the application or initial interview phase.

- Technical Insight: Be wary of online forms that aren’t secured (look for “https://” and a padlock icon in the browser address bar) when submitting any information, but especially sensitive data. However, even a secure form can lead to a scammer if the “company” itself is fake.

- What to Do: Never provide your SSN, bank account information, or credit card details early in the application process. If asked, politely decline and state that you are comfortable providing such information after receiving a formal, written job offer. If they pressure you, disengage immediately. The FTC explicitly warns against providing such information upfront.

4. High-Pressure Tactics and an Urgency to Act Immediately

Scammers often try to rush you into making decisions before you have time to think critically or do your research.

- The Red Flag: You receive a job offer very quickly after applying, sometimes even without a proper interview. The “recruiter” pressures you to accept the offer immediately, perhaps claiming it’s a “limited-time opportunity” or that “other candidates are waiting.” They might create a false sense of urgency to get you to sign documents or provide information hastily.

- Why it’s a Concern: Legitimate hiring processes take time. They involve application reviews, multiple interview rounds, reference checks, and internal deliberations. Extreme pressure to accept an offer quickly is a manipulation tactic designed to prevent you from scrutinizing the offer or the company.

- Technical Insight: Look for phrases like “act now,” “urgent hiring,” or offers that seem too good to be true with a very short acceptance window. Scammers thrive on impulsive decisions.

- What to Do: Don’t be rushed. A legitimate employer will understand if you need a reasonable amount of time (e.g., a few days to a week) to consider a job offer. If you feel unduly pressured, it’s a strong signal to step back and investigate further.

5. Unusually High Salary for Minimal Experience or Effort

The age-old adage “if it sounds too good to be true, it probably is” is particularly relevant in the job market.

- The Red Flag: The advertised salary is significantly higher than the industry average for the role and your experience level. The job promises substantial income for very little work, minimal skills, or no prior experience.

- Why it’s a Concern: While everyone wants a great salary, offers that are wildly out of sync with market rates are often bait used by scammers. They know that the prospect of high pay can cloud judgment and make people overlook other warning signs.

- Technical Insight: Research average salaries for the role in your geographic area using legitimate salary aggregator websites like Glassdoor, Salary.com, or the Bureau of Labor Statistics (BLS) Occupational Outlook Handbook. This data provides a benchmark against which to compare the offer. The BLS OOH is an excellent government resource for career and salary information.

- What to Do: Be realistic. If an offer seems inflated, investigate the company thoroughly. Ask probing questions about the compensation structure and why the pay is so generous.

6. Interviews Conducted Exclusively via Instant Messaging or Unsecured Platforms

While initial screenings might use various communication tools, the entire interview process being limited to non-verbal, text-based platforms is suspicious.

- The Red Flag: The “interview” is conducted solely through instant messaging (e.g., Google Hangouts, WhatsApp, Telegram) or a basic online form, with no voice or video interaction. The interviewer may be evasive when asked for a video call or an in-person meeting (if local).

- Why it’s a Concern: Legitimate companies usually want to see and speak with potential hires, especially for roles requiring significant responsibility or interaction. Text-only interviews make it easy for scammers to hide their identity, use scripts, and operate from anywhere in the world. They also prevent you from assessing the interviewer’s professionalism and the legitimacy of the work environment.

- Technical Insight: While many companies use platforms like Microsoft Teams or Zoom for video interviews, scammers might try to impersonate these. Ensure any links for video interviews direct you to the legitimate platform and that the interviewer’s demeanor and background appear professional. Be wary if they insist on keeping their camera off without a good reason.

- What to Do: Insist on a video interview at a minimum. If the role is local, suggest an in-person meeting at their office. If they refuse or make excuses, it’s a major red flag.

7. Non-Existent or Inconsistent Online Presence

Legitimate companies, especially those large enough to be hiring multiple roles, will have a verifiable and professional online footprint.

- The Red Flag: You can’t find a credible company website. If a website exists, it looks amateurish, has very little content, contains stock photos that appear on many other sites, or has domain registration details that are hidden or very recent. There might be no mention of the company in news articles, industry directories, or on professional networking sites like LinkedIn. Contact information might be missing or lead to generic voicemail boxes.

- Why it’s a Concern: A lack of a professional online presence makes it difficult to verify the company’s existence or legitimacy. Inconsistencies (e.g., a website claiming decades of history but a domain registered last month) are strong indicators of a sham operation.

- Technical Insight: Use WHOIS lookup tools (e.g., whois.com, ICANN Lookup) to check the registration date and ownership details of the company’s website domain. A very recently registered domain for a supposedly established company is suspicious. Search for the company name on LinkedIn, Glassdoor, and major search engines. Look for reviews, employee profiles, and news mentions. Be cautious if the only results are the job ad itself.

- What to Do: Thoroughly research the company online. Look for a physical address and verify it using Google Maps (check Street View if available – does it look like a business, or a residential address, or an empty lot?). If you find little to no credible information, or if the information is contradictory, avoid engaging further.

8. Requests for Upfront Payment or Purchase of Equipment/Software

This is a classic scam tactic designed to get money directly from job seekers.

- The Red Flag: You are told you need to pay a fee for training, onboarding, a background check, special software, or work equipment before you can start the job. They might promise reimbursement later, but the initial outlay comes from your pocket.

- Why it’s a Concern: Legitimate employers pay for their employees’ training and the tools required to do their jobs. They do not charge fees to hire someone. Asking for upfront payment is a clear sign of a scam. As the FTC notes, “Honest employers, including the federal government, will never ask you to pay to get a job.”

- Technical Insight: Be especially wary if the payment is requested via unconventional methods like wire transfers (Western Union, MoneyGram), gift cards, or cryptocurrency, as these are difficult to trace and recover.

- What to Do: Never pay for a job. Do not send money for training, supplies, or anything else as a condition of employment. If an “employer” asks for this, cease all communication and report the ad.

9. Job Offer Without a Proper Interview or Verification

While flattering, receiving a job offer without any meaningful interaction or verification of your skills is highly suspicious.

- The Red Flag: You receive a job offer shortly after applying, without participating in any real interview (no phone screen, no video call, no in-person meeting). The offer might be based solely on your resume or a brief online questionnaire.

- Why it’s a Concern: Hiring is a significant investment for companies. They almost always conduct thorough interviews to assess a candidate’s skills, experience, and cultural fit. Bypassing this critical step suggests the “offer” isn’t legitimate and is likely a setup for one of the scams mentioned earlier (data theft, financial fraud).

- Technical Insight: Consider the timeline. Legitimate hiring processes can take weeks, sometimes months. An offer within hours or a day or two of applying, without substantial interaction, is a major anomaly.

- What to Do: Be skeptical of unsolicited or extremely quick job offers. If you haven’t been properly interviewed, treat the offer as a probable scam.

10. Mismatched Email Domains, Website URLs, and Contact Details

Attention to detail can save you from a scam. Scammers often rely on applicants overlooking small inconsistencies.

- The Red Flag: The email address of the sender doesn’t quite match the official company domain (e.g.,

[email protected]instead of[email protected]). The website URL provided might be slightly misspelled or use a different top-level domain (e.g.,companyname.netinstead ofcompanyname.com). Phone numbers may not match official company listings or might be international numbers for a supposedly local job. - Why it’s a Concern: These subtle discrepancies are often attempts to impersonate legitimate companies. Scammers register domains or create email addresses that are close enough to the real thing to fool unsuspecting individuals.

- Technical Insight: Carefully examine every email address and URL. Don’t just click on links in emails; type the company’s official website address (found through a separate, trusted search) directly into your browser. Hover your mouse cursor over links in emails to see the actual destination URL before clicking. For phone numbers, do a quick online search to see if they are officially associated with the company.

- What to Do: Always verify contact details and web addresses against the company’s official, independently verified sources. If you notice any mismatches, however small, treat it as a significant red flag. Report such impersonation attempts to the legitimate company as well.

Beyond the Red Flags: Proactive Steps for a Safer Job Search

Recognizing red flags is crucial, but you can also take proactive steps to protect yourself:

- Use Reputable Job Boards: Stick to well-known, established job search websites. Even then, remain vigilant, as scammers can sometimes infiltrate these platforms.

- Research Companies Thoroughly: Before applying, or at least before engaging deeply, research the company. Look for their official website, LinkedIn presence, news articles, and employee reviews.

- Guard Your Personal Information: Never provide your SSN, bank details, or other sensitive information during the initial application or interview stages.

- Trust Your Gut: If something feels off about a job posting or an interaction with a recruiter, it probably is. Don’t ignore your intuition.

- Create Strong, Unique Passwords: Use different, complex passwords for your job search accounts and your email.

- Beware of Unsolicited Offers: Be extra cautious if you receive a job offer for a position you never applied for.

- Document Everything: Keep records of job postings, email communications, and any other interactions. This can be helpful if you need to report a scam.

- Report Suspicious Activity: If you encounter a fake job ad, report it to the job board where you saw it, the Federal Trade Commission (FTC), and the FBI’s Internet Crime Complaint Center (IC3).

For Decision Makers: Protecting Your Company’s Reputation

Fake job ads don’t just harm job seekers; they can also damage the reputation of legitimate companies whose names are used in these scams. Decision-makers can take steps to mitigate this:

- Monitor for Impersonation: Regularly search for your company name on job boards and social media to check for unauthorized or fake postings.

- Educate Your HR Team: Ensure your recruitment team follows consistent, professional communication protocols and is aware of impersonation tactics.

- Maintain a Clear Careers Page: Have an easily accessible and up-to-date careers page on your official website where all legitimate job openings are listed. Direct potential applicants there.

- Use Consistent Corporate Domains: Ensure all recruitment communications come from official company email addresses.

- Provide a Reporting Mechanism: Make it easy for job seekers to report suspected fraudulent use of your company’s name.

- Publicly Address Scams: If you become aware of your company being impersonated, consider issuing a public statement to warn job seekers.

Conclusion: Navigate with Vigilance

The search for a new job should be an exciting chapter, not a gateway to exploitation. By understanding the motivations behind fake job advertisements and arming yourself with the knowledge of these ten red flags, you can significantly reduce your risk of falling victim. The digital landscape of recruitment offers incredible opportunities, but it also provides cover for those with malicious intent.

Remember, legitimate employers will be professional, transparent, and will not pressure you into compromising your personal information or finances. Approach every job opportunity with a healthy dose of skepticism, conduct your due diligence, and trust your instincts. Your dream job is out there, and by being informed and cautious, you can ensure that the offer you accept is genuine, paving the way for a secure and prosperous future.

You might also like: Is the Gig Economy Dying or Evolving?